Brexit Report

We are a registered Service Provider with InterTradeIreland in relation to providing your business with a report and advice on specific issues such as movement of labour, goods, services and currency management. InterTradeIreland provide a voucher worth up to £2,000/€2,250 towards professional advice in relation to Brexit matters. You can register for this support using […]

Accountancy Job Vacancies

Two Accountancy maternity cover positions required to be fulfilled immediately: 1. Qualified Chartered Accountant or part-qualified with good experience. 2. Qualified Accounting Technician or experienced book-keeper. The successful candidate will be required to prepare or assist in the preparation of accounts, submission of tax returns and have a good knowledge of VAT, PAYE, RCT and […]

TAX CHANGES COMING INTO FORCE

There are a raft of new tax changes coming into force on 6 April 2016. Find enclosed our newsletter which provides a summary of the changes which may affect you.

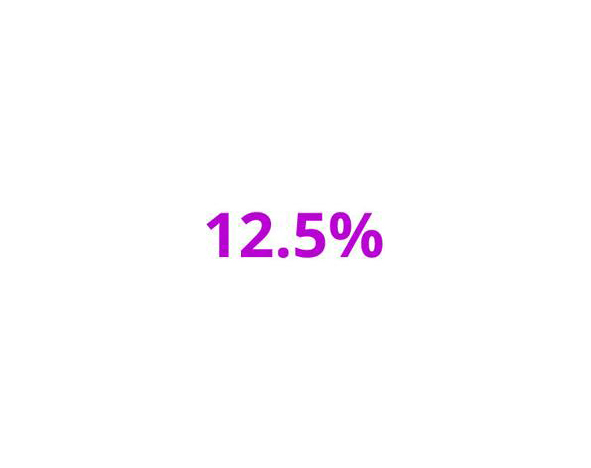

NI CORPORATION TAX RATE

The NI corporation tax rate is scheduled to reduce to 12.5%, well below the standard rate for the rest of the UK. Will it apply to you? Contact us to be sure but click here for a brief summary of the conditions.

PERSONAL SAVINGS ALLOWANCE

How much is the personal savings allowance? Basic-rate (20%) taxpayers – will be able to earn £1,000 interest with no tax (so a max tax saving of £200 compared with before). Higher-rate (40%) taxpayers – will be able to earn £500 interest with no tax (so a max tax saving of £200 compared with before). […]

COMPANIES HOUSE CONFIRMATION STATEMENT

From June 2016, annual returns will be replaced by a confirmation statement. To review what this means and what the changes are, click here.

BMC ACCOUNTANTS SPONSOR EDENDORK GAC FUNDRAISER

BMC Accountants Ltd helped launch the Edendork GAC bike race from Kildare to Tyrone on Saturday 28th May 2016 in memory of their former club chairman Dessie Fox. Dessie, who was brother in law of our managing director Brian McCullagh, was murdered in 1990 when he was robbed on his way to the racetrack with […]